DPM Metals Announces Inferred Mineral Resource Estimates of 2.6 Million Gold Ounces and 1.9 Billion Pounds of Copper at the Rakita Camp

TORONTO, Dec. 02, 2025 (GLOBE NEWSWIRE) -- DPM Metals Inc. (TSX: DPM, ASX: DPM) (ARBN: 689370894) (“DPM” or “the Company”) is pleased to announce initial Mineral Resource Estimates (“MRE”) for the Dumitru Potok, Rakita North and Frasen prospects in eastern Serbia, all located within one to two kilometres of planned Čoka Rakita infrastructure.

Highlights

- Establishes a potential district scale platform, with a combined Inferred MRE of 84.4 million tonnes at a grade of 0.97 g/t gold and 1.02% copper for 2.6 million ounces of gold and 1.9 billion pounds of copper.

- Dumitru Potok prospect represents a significant higher-grade core of the Inferred MRE. When viewed separately, this prospect comprises 64.1 million tonnes at a grade of 1.07 g/t gold and 1.09% copper for 2.2 million ounces of gold and 1.5 billion pounds of copper.

- Significant exploration potential for continued mineral resource growth at low-cost per-ounce discovery costs, as all three deposits remain open in multiple directions.

- Initial phase of metallurgical testwork indicates high recoveries are achievable, generating a potentially saleable copper and gold concentrate.

-

Pathway to low-risk execution, leveraging infrastructure designs based on successful DPM projects, underpinned by DPM’s competitive advantage of 20+ years of in-country experience, for a camp-wide development strategy that accelerates value and growth.

“These mineral resources demonstrate the Rakita camp’s potential as a district-scale gold-copper system. Each of Dumitru Potok, Rakita North and Frasen remain open in multiple directions and sit alongside several high-potential targets along a six-kilometre trend,” said David Rae, President and Chief Executive Officer of DPM Metals.

“Since we announced these initial discoveries only 14 months ago, these prospects have rapidly grown into a significant gold-copper Inferred mineral resource, a remarkable achievement over a short period of time which underscores the significant potential of the Rakita camp.

“Together with the result of the Čoka Rakita feasibility study, this confirms the Rakita camp as a Tier One asset for DPM, offering a rare combination of scale, grade and longevity. Further upside potential remains as we test the continuation of the system with step-out drilling on the adjacent licence.”

Inferred Mineral Resource Estimate

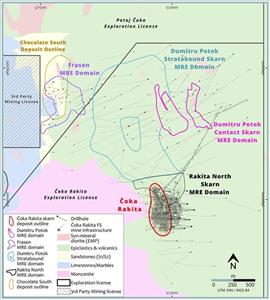

The Dumitru Potok, Rakita North and Frasen prospects are located adjacent to the Čoka Rakita deposit and situated on the Company’s Čoka Rakita and Potaj Čuka exploration licenses (Figure 1). The total Inferred MRE is comprised of 2.6 million ounces of gold and 1.9 billion pounds of copper contained within 84.4 million tonnes grading 0.97 g/t gold and 1.02% copper and assumes an underground mining scenario.

Table 1. Dumitru Potok, Rakita North and Frasen Mineral Resource Estimate, effective as of October 23, 2025.

| Deposit | Resource Category |

Tonnes (Mt) |

Gold Grade (g/t) |

Contained Gold (K oz.) |

Copper Grade (%) |

Contained Copper (Mlbs.) |

| Dumitru Potok | Inferred | 64.1 | 1.07 | 2,206 | 1.08 | 1,535 |

| Rakita North | Inferred | 17.9 | 0.56 | 320 | 0.84 | 331 |

| Frasen | Inferred | 2.4 | 1.21 | 95 | 0.70 | 37 |

| Total | Inferred | 84.4 | 0.97 | 2,621 | 1.02 | 1,903 |

- Tonnages are rounded to the nearest 0.1 million tonnes to reflect that this is an estimate.

- Metal content is rounded to the nearest 1 thousand ounces or 1 million pounds to reflect that this is an estimate.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- All blocks include a net smelter revenue (“NSR”) formula that utilises long-term metal prices, metallurgical recoveries, payability terms, treatment charges, refining charges, penalty charges, concentrate transport costs, and royalties.

- Mineral Resources are reported within MSO shapes generated at a US$50/t NSR cut-off, to ensure Mineral Resources meet reasonable prospects for eventual economic extraction as per CIM Estimation of Mineral Resources and Mineral Reserves Best Practices Guidelines prepared by the CIM Mineral Resource & Mineral Reserve Committee and adopted by the CIM Council on November 29, 2019.

- The QP is not aware of any legal, political, environmental, or other risk factors that might materially affect the estimate of Mineral Resources.

The cut-off date for the drillhole database was October 23, 2025. The data set includes a total of 194 drillholes, representing 102,550 meters of drilling. In the Dumitru Potok area, current drillhole spacing ranges from approximately 80 metres to 200 metres, while drill density in the Frasen zone ranges from 30 metres to 80 metres. Drillhole spacing in Rakita North is between 80 metres and 150 metres.

Mineral Resource domains were created within areas of logged skarn alteration, guided by economic composites generated using a 0.5% copper-equivalent cut-off value. The underlying geological relationships were honoured by lithological and structural modelling, which was used to control domain geometries and boundaries.

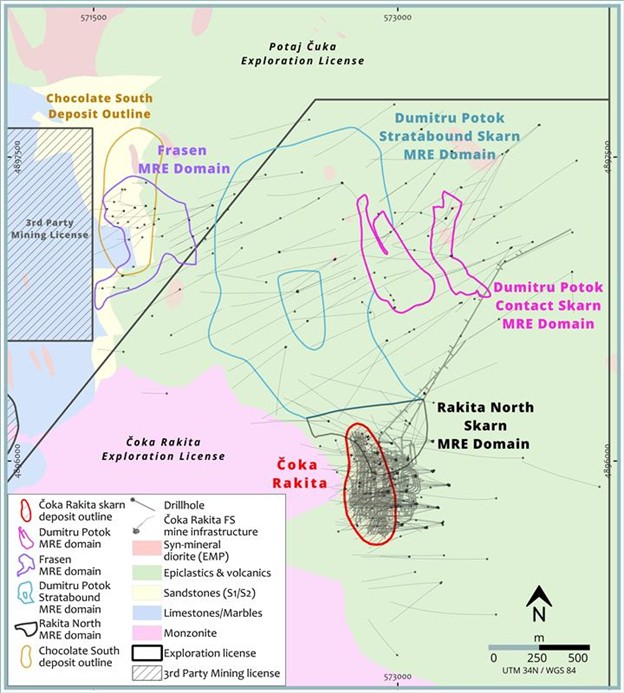

Parent cell block grade estimates for Au, Cu, Ag, Pb, Zn, Mo, Fe, Sb, S, and As, were generated using inverse distance squared interpolation. Mean bulk densities were assigned by lithological unit or mineralized domain. Grade capping was applied to the composite dataset to mitigate the influence of extreme grade values. Given the current drill spacing, a parent cell block size of 50 mE × 50 mN × 5 mZ was utilized, with sub-celling applied to ensure accurate representation of mineralized domain geometries and volumes. A representative cross section though the block model is shown in Figure 2.

A Net Smelter Revenue (“NSR”) calculation has been developed based on initial metallurgical testwork results combined with DPM’s knowledge of potential smelter terms, royalites, onsite and offsite costs. The NSR calculation assumes a payable copper-gold-silver concentrate will be generated, as well as a subordinate zinc concentrate for the Frasen polymetallic prospect. The NSR calculation assumes a copper price of US$4.00 per pound, gold price of US$2,600 per ounce, silver price of US$26 per ounce for all prospects as well as a zinc price of US$2,800 for the Frasen prospect.

The MRE meets the requirements of reasonable prospects for eventual economic extraction (RPEEE) by reporting only material above a US$50 NSR cut-off that falls within the optimized mineable shapes, ensuring mineralization continuity. Optimized shapes use a minimum length constraint of 50 metres, width between 5 metres and 30 metres and a vertical mining height of 5 metres. The reported mineralization exceeds a US$50 NSR cut-off. Any internal or external dilution within the mining shapes is not reported in the MRE. Oxide and transitional mineralization that constitutes the Chocolate South deposit, part of the Timok Gold Project, has been excluded from the estimate.

The MRE was classified as Inferred Mineral Resources, informed by adequate drill spacing, appropriate QA/QC controls ensuring, quality drilling and sampling data, suitable geologic continuity providing, confidence in the geological and mineralization interpretations. Further drilling is required to improve confidence in both the geologic interpretation and the continuity of mineralization.

Prospect Geology

The Dumitru Potok prospect is located approximately one kilometre northeast of Čoka Rakita. The deposit geology is comprised of a sub-vertical, causative monzodiorite intrusive body and the mineralization manifests itself as proximal magnetite-garnet-hematite ± pyroxene copper–gold skarn, along a marble-intrusive contact. The mineralization has an approximate lens-like form, with a 600-metre strike length, is up to 200 metres wide and has been traced over a 400-metre vertical extent.

Away from the intrusion, the Dumitru Potok mineralization continues as a stratabound, manto-like skarn, forming tabular Cu-Au-Ag bodies along a conglomerate-marble unconformity. Mineralization in this zone has been traced for over one kilometer strike length, up to one kilometer away from the causative intrusive with variable thickness, from 5 metres to 40 metres.

The Frasen prospect is a more distal manifestation of the same body, characterised as a tabular zone of manto-like carbonate-hosted replacement and skarn Au-Ag-Cu-Zn-Pb mineralization on the conglomerate-marble contact. The Frasen porphyry, which is not included within this MRE, cuts through the Dumitru Potok zone, hosting well-developed stockwork porphyry gold-copper veins at near surface levels.

The Rakita North prospect is a broad zone of marble-hosted copper-gold-silver mineralization on the northern flank of the Čoka Rakita deposit, located approximately 400 metres below planned underground infrastructure. The mineralization at Rakita North is a combination of manto-like skarn mineralization on the upper and lower contact, as well as more discrete stratabound skarns and structurally controlled subvertical stockwork veins, present over the entire marble lithological package.

The geology, mineralization and metallurgical characteristics of the prospects are different from the Čoka Rakita project. It is expected to require its own separate project infrastructure for mining and processing.

Metallurgical Testwork Results

Metallurgical testing from representative 30-kilogram composite samples from the Frasen, Dumitru Potok and Rakita North discoveries were sent for testwork during 2025 (Table 2). Testing was undertaken at the Wardell Armstrong International laboratory in the United Kingdom, which is independent of DPM.

Composites BI1, DP1, DP2, DP3 and RA1 were subjected to a preliminary characterization study involving comminution testing, chemical analysis and mineralogical investigation on three size fractions before being subjected to a program of gravity and flotation testing to assess the recovery of copper and gold. Composites DP4, DP5 and DP6 were subjected to characterization only by chemical analysis and flotation testing to assess the recovery of copper, gold and silver, as part of a subsequent phase of testing.

Table 2. Summary metallurgical head assays based on 1.0kg extracted lot for each example.

|

Composite ID |

Prospect |

Cu | Fe | Au | Ag | S TOT |

| % | % | ppm | ppm | % | ||

| BI1 | Frasen Polymetallic Skarn | 2.03 | 25.03 | 2.46 | 91.30 | 21.11 |

| DP1 | Dumitru Potok Contact Skarn E | 3.56 | 20.42 | 2.87 | 20.30 | 3.33 |

| DP2 | Dumitru Potok Contact Skarn E | 1.16 | 8.82 | 1.63 | 4.70 | 1.05 |

| DP3 | Dumitru Potok Contact Skarn W | 2.85 | 8.25 | 1.77 | 17.53 | 1.14 |

| DP4 | Dumitru Potok Contact Skarn E | 1.66 | 10.58 | 1.56 | 11.69 | 0.94 |

| DP5 | Dumitru Potok Contact Skarn W | 1.9 | 9.52 | 1.4 | 19.61 | 0.51 |

| DP6 | Dumitru Potok Stratabound | 1.63 | 7.57 | 1.72 | 9.85 | 1.00 |

| RA1 | Rakita North Skarn | 1.17 | 12.93 | 0.91 | 4.86 | 1.66 |

Bond ball mill Work Index test classified both the Frasen and Dumitru Potok mineralization as ‘Medium’ with respect to fine ore grinding. With work index for Frasen BI1 of 10.27kWh/t. Work index values of 11.3kWh/t for DP1, 12.44kWh/t for DP2 and 13.27kWh/t for DP3. Knelson gravity testwork showed highly variable gold and copper recoveries. Due to the copper losses and poor gold deportment in the gravity concentrates, further flotation testwork on the Knelson gravity tailings was not undertaken.

Rougher-Cleaner flotation testwork was conducted with various optimization steps employed. Table 3 shows testwork results based on a primary grind p80 of 75μm with subsequent regrind at less than 30μm before a cleaner flotation stage. Although some variability of recovery, grade and mass pull is evident, the preliminary flotation testwork on Dumitru Potok, Rakita North and Frasen composites produced saleable gold-copper concentrate grades between 18% to 39% for copper and 14 g/t to 31 g/t for gold.

Table 3. Summary of Rougher-Cleaner testwork results.

| Composite ID |

Mass Weight (%) |

Concentrate Grade | Recovery (%) | ||||||

| Cu % |

Au ppm |

Ag ppm |

S(TOT) % |

Cu | Au | Ag | S(TOT) | ||

| BI1 | 7.44 | 19.7 | 17.9 | - | 32.2 | 72.2 | 55.5 | - | 11.1 |

| DP1 | 13.43 | 26.2 | 20.2 | 130.7 | 24.5 | 90.4 | 77.5 | 82.3 | 90.3 |

| DP2 | 2.65 | 18.2 | 18.2 | 64.1 | 17.0 | 76.4 | 60.2 | 71.3 | 72.5 |

| DP3 | 7.86 | 35.5 | 16.2 | 243.8 | 13.7 | 93.7 | 70.2 | 91.5 | 92.9 |

| DP4 | 2.71 | 37.0 | 21.1 | 229.5 | 21.3 | 60.3 | 36.6 | 53.1 | 61.2 |

| DP5 | 4.13 | 39.0 | 27.4 | 349.3 | 10.5 | 84.9 | 80.9 | 73.6 | 84.8 |

| DP6 | 4.04 | 32.1 | 30.7 | 176.0 | 19.4 | 79.3 | 72.1 | 72.1 | 78.5 |

| RA1 | 4.25 | 22.4 | 14.4 | 59.6 | 19.2 | 82.8 | 63.0 | 53.2 | 49.3 |

The testwork shows good copper, gold and silver recoveries and significant precious metals credits, indicating that single cleaner stage concentrate would be adequate for conventional smelter marketing. Numerous areas for optimization of the testing conditions were identified during the program, which will be explored during subsequent phases of testing.

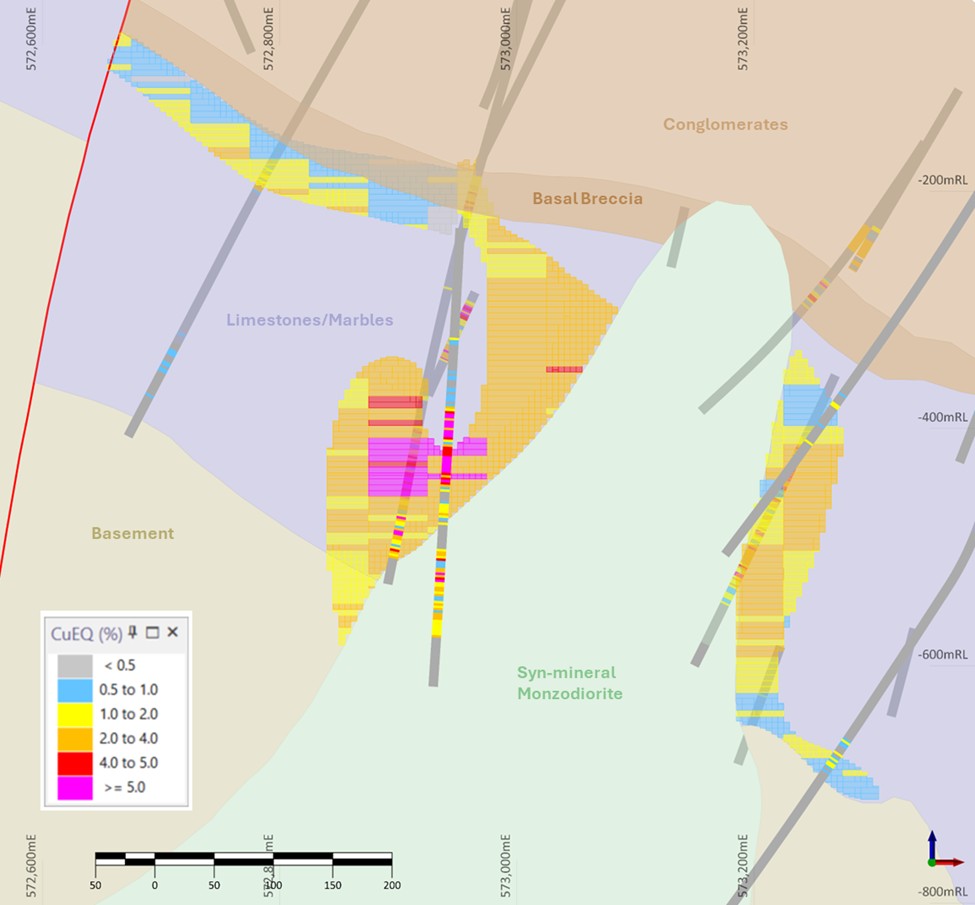

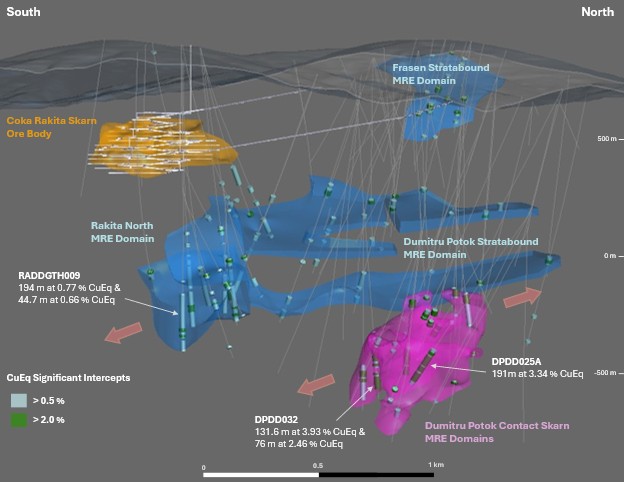

Deposits Remain Open for Further Growth Potential

The contact skarn mineralization at the Dumitru Potok prospect remains open to the north, south and partially at depth, whereas the Dumitru Potok stratabound mineralization remains open in numerous locations (Figure 3). At the Rakita North Prospect, mineralization remains open to the south and east. Additionally, at the Frasen prospect, the mineralized horizon is open to the north and south, with opportunity to infill and improve resource definition with further drilling in the main deposit. At a camp scale, DPM has identified numerous porphyry, skarn and carbonate replacement type exploration targets.

Next Steps

Drilling is currently paused on the Čoka Rakita exploration licence pending the normal course renewal of permits, and is anticipated to re-commence in the second quarter 2026. Meanwhile, active drill testing is ongoing at the neighboring Potaj Čuka exploration licence, where further geophysical surveys combined with 20,000 metres of diamond drilling are planned for 2026.

Upon renewal of the permit, the Company has planned 20,000 metres of diamond drilling at the Čoka Rakita exploration licence. A significant component of that drilling will be allocated to infilling and extending mineralization at the Dumitru Potok prospect and increasing the drilling density prior to initiating any Preliminary Economic Assessment or other economic study. Additional metallurgical testwork is planned on samples aligned with the MRE, combined with geometallurgical modelling, to better understand and classify metallurgical variability.

Ongoing Stakeholder Engagement

Consistent with the approach across all operations, DPM seeks to build and maintain strong partnerships with local communities and governments. The Company has had a local presence in Serbia since 2004 and has developed strong relationships in the region and will continue to proactively engage with all stakeholders as the Čoka Rakita project and additional exploration activities advance.

The Company’s approach to advancing the growth potential of the Rakita camp will leverage its proven track record in stakeholder engagement, project development and operational readiness, as well as its proximity to DPM operating mines with readily available access to well-established technical support functions.

DPM Investor Day to be held December 4, 2025

DPM is hosting an investor day at 9 a.m. EST on Thursday, December 4, 2025, which will feature highlights of the Rakita camp MRE by key members of the project development team. As well, DPM’s executive and technical teams will also present updates and insights on:

- The Čoka Rakita feasibility study

- Chelopech exploration

- Progress at Vareš

Q&A sessions will follow the presentations, providing an opportunity for direct engagement with the Company leadership.

The in-person event will be webcast, and a replay of the event will be available on the Company’s website at www.dpmmetals.com within two hours of the event’s conclusion.

In order to provide investors in an Australian time zone the opportunity to engage with DPM’s management team, DPM will also host a virtual Q&A session on December 5, 2025 at 11 a.m. AEDT (December 4, 2025 at 7 p.m. EST).

| Event | Details |

| Investor Day |

December 4, 2025 9 a.m. EST a.m.

|

| Management Q&A |

December 5, 2025 11 a.m. AEDT (December 4, 2025 at 7 p.m. EST)

|

Figure 1. Surface location of the Dumitru Potok, Rakita North and Frasen prospects, relative to the Čoka Rakita deposit.

Figure 2. Cross Section through the block model and geologic model at the Dumitru Potok prospect. Section 4,896,980mN and thickness 150m. Copper-equivalent values were derived using NSR factors.

Figure 3. Snapshot of a 3D model looking west displaying the positions of the Mineral Resource domains relative to the Čoka Rakita orebody and the planned underground development feasibility study design, as well as highlights from the previously reported intercepts.

For more information regarding previously reported intercepts, refer to the news release dated September 10, 2025 entitled “Dundee Precious Metals Reports High-Grade Intercepts at Dumitru Potok of 131.6 metres grading 3.93% CuEq and 76 metres at 2.47% CuEq”, which is available on the Company’s website at www.dpmmetals.com and on SEDAR+ at www.sedarplus.ca.

Technical Information and Technical Report Filing

The MRE for Čoka Rakita and other scientific and technical information which supports this news release was prepared by DPM with review and guidance at various stages provided by Malcolm Titley, MAIG, Associate Principal Consultant, Environmental Resources Management Ltd. (“ERM”), and Richard Wagner, Principal Metallurgist, ERM, in accordance with Canadian regulatory requirements set out in National Instrument 43-101 Standards for Disclosure for Mineral Projects (“NI 43-101”).

Both Malcolm Titley and Richard Wagner are both Qualified Persons (“QP”) for Mineral Resources and Metallurgy, as defined under NI 43-101 and are both independent of the Company.

Ross Overall, Director, Corporate Technical Services, of the Company, who is a QP, as defined under NI 43-101, has reviewed and approved the contents of this news release. Verification included review of QAQC data, 3D models, NSR calculations and mineral resource parameters.

A technical report for the Dumitru Potok, Rakita North and Frasen prospects, prepared in accordance with NI 43-101, will be filed under the Company’s profile on SEDAR+ at www.sedarplus.ca within the required regulatory deadline. Readers are encouraged to read the technical report in its entirety, including all qualifications, assumptions, exclusions and risks that relate to the Mineral Resource.

The MRE and related information in this news release may not be comparable to similar information made public by U.S. companies, subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

DPM is not required to report on minerals exploration results, mineral resources and ore reserves in accordance with Chapter 5 of the ASX Listing Rules or the JORC Code 2012 due to DPM’s Foreign Exempt Listing on the ASX. DPM’s mineral reserves and mineral resources are prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum—Definition Standards adopted by the CIM Council on 10 May 2014, as required by Canadian securities regulatory authorities, which may differ from the requirements of the ASX Listing Rules and the JORC Code 2012.

About DPM Metals Inc.

DPM Metals Inc. is a Canadian-based international gold mining company with operations and projects located in Bulgaria, Bosnia and Herzegovina, Serbia and Ecuador. Our strategic objective is to become a mid-tier precious metals company, which is based on sustainable, responsible and efficient gold production from our portfolio, the development of quality assets, and maintaining a strong financial position to support growth in mineral reserves and production through disciplined strategic transactions. This strategy creates a platform for robust growth to deliver above-average returns for our shareholders. DPM trades on the Toronto Stock Exchange (symbol: DPM) and the Australian Securities Exchange (symbol: DPM).

For further information please contact:

Jennifer Cameron

Director, Investor Relations

Tel: (416) 219-6177

jcameron@dpmmetals.com

Cautionary Note Regarding Forward Looking Statements

This news release contains “forward looking statements” or “forward looking information” (collectively, “Forward Looking Statements”) that involve a number of risks and uncertainties. Forward Looking Statements are statements that are not historical facts and are generally, but not always, identified by the use of forward looking terminology such as “plans”, “targets”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “outlook”, “intends”, “anticipates”, “believes”, or variations of such words and phrases or that state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms or similar expressions. The Forward Looking Statements in this news release relate to, among other things; the estimation of MRMR and the realization of such mineral estimates; and expected next steps in the development of the project, timing of permitting activities and other governmental approvals; potential gold recoveries; and the price of gold, copper, silver, and other commodities. Forward Looking Statements are based on certain key assumptions and the opinions and estimates of management and the QPs, as of the date such statements are made, and they involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any other future results, performance or achievements expressed or implied by the Forward Looking Statements. In addition to factors already discussed in this news release, such factors include, among others, risks relating to the Company’s business, including possible variations in mineralized grade and recovery rates; changes in project parameters; uncertainties with respect to actual results of current exploration activities; uncertainties inherent to the estimation of the MRE; uncertainties inherent with conducting business in foreign jurisdictions where corruption, civil unrest, political instability and uncertainties with the rule of law may impact the Company’s activities; the impact of the conflicts in Ukraine and the Middle East, including resulting changes to the Company’s supply chain and costs of supplies; product shortages; delivery and shipping issues; additional delays in the advancement of the project, including with respect to the commencement of drilling activities; closures and/or failure of plant, equipment or processes to operate as anticipated; labour force shortages; fluctuations in metal and acid prices and foreign exchange rates; limitation on insurance coverage; accidents, labour disputes and other risks of the mining industry; the ability of the Company, stakeholders and local communities to realize the anticipated benefits of the project; delays in obtaining governmental approvals or in the completion of exploration or development activities; opposition by social and non-government organizations to mining projects; unanticipated title disputes; claims or litigation; cyber-attacks and other cybersecurity risks; changes to tax regimes in the jurisdictions in which the Company operates; as well as those risk factors discussed or referred to in any other documents (including without limitation the Company’s most recent Annual Information Form) filed from time to time with the securities regulatory authorities in all provinces and territories of Canada and available on SEDAR+ at www.sedarplus.ca. The reader has been cautioned that the foregoing list is not exhaustive of all factors which may have been used. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward Looking Statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that Forward Looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company’s Forward Looking Statements reflect current expectations regarding future events and speak only as of the date hereof. Unless required by securities laws, the Company undertakes no obligation to update Forward Looking Statements if circumstances or management’s estimates or opinions should change. Accordingly, readers are cautioned not to place undue reliance on Forward-Looking Statements.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/fb848583-c862-4764-95ba-62f504680044

https://www.globenewswire.com/NewsRoom/AttachmentNg/a5a7b21a-6987-44c5-822d-f5f080c72c7a

https://www.globenewswire.com/NewsRoom/AttachmentNg/f074dfb2-33de-444f-8c64-eebb1bb4af52

Figure 1

Surface location of the Dumitru Potok, Rakita North and Frasen prospects, relative to the Čoka Rakita deposit.

Figure 2

Cross Section through the block model and geologic model at the Dumitru Potok prospect. Section 4,896,980mN and thickness 150m. Copper-equivalent values were derived using NSR factors.

Figure 3

Snapshot of a 3D model looking west displaying the positions of the Mineral Resource domains relative to the Čoka Rakita orebody and the planned underground development feasibility study design, as well as highlights from the previously reported intercepts.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.